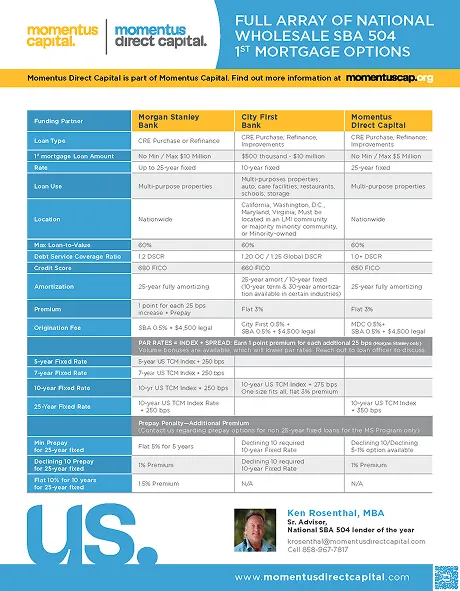

A Full Array of National Wholesales SBA 1st Mortgage Options

Solutions For Your Commercial Real Estate Needs

Don’t qualify for a Small Business Administration (SBA) or traditional bank loan? Looking to jumpstart a project in a census-designated low-to-moderate income zone? No problem! Our Impower loan can provide a responsible and flexible way to purchase commercial real estate and build long-term equity.

Who We Work With

Whether you are a non-bank lender, credit union, CDFI, CDC, loan broker, or real-estate broker, our products bring real value to your business by offering rates and terms to satisfy your customer’s needs and win deals

How It Works

Direct Funding

Our funding partner directly funds the loan and thus the selling lender does not have to use its own capital. This transactional approach with our funding partners allows the selling lender to maintain a broad client relationship.

Purchase

Selling lender books the first mortgage loan on its balance sheet, then sells it to the funding partner.

SBA 1st Mortgage Terms & Highlights

| Eligible Uses | New commercial real estate purchases, construction take-outs, cash-out refinances, and refinancing of existing SBA 7(a) or SBA 504 1st mortgages |

| Property Types | Office, industrial, retail, R&D, manufacturing, medical/dental, veterinary, auto repair, schools; select care facilities, restaurants, and storage in California and the Washington, D.C. area, if NMTC-eligible |

| Geography | Some options can lend in all 50 states |

| Loan Terms | Up to 25-year fully amortizing loans with 5, 10, and 25-year fixed rates; also 30-year amortization (due in 10) with 10-year fixed available for qualifying properties |

| Location | Nationwide |

| Interest Rates | Risk-based pricing from 200–400 basis points over Treasury Constant Maturity Index |

| Credit Requirements | Minimum FICO 650–680; DSCR 1.0–1.25 based on last tax return and interim period |

| Prepayment Penalties | Ranging from 5 to 10 years depending on loan structure |

| Funding & Partnerships | Project sizes up to $20 million; SBA 504 2nd mortgages funded by Certified Development Companies with fixed rates in the mid-6% range — no banking relationship ever required |

Property Types

Multi-purpose Properties

Examples of commercial properties may include: Office, industrial, retail, R&D, manufacturing, medical/dental, veterinary, auto repair, schools; select care facilities, restaurants, and storage in California & Washington, D.C. area if NMTC-eligible

Special-purpose Properties

Examples of commercial properties may include: Gas stations, auto dealers, hotels, restaurants, car washes, amusement, care facilities, storage facilities

Delivering Value to Our Customers

Offense:

- Beat your competition while keeping the full client relationship

- Earn unlimited dollar amount of fee income (up to 10 points) — not on all our products

- Earn premium income

Market our rates and terms as your own and get new business

Defense:

- Refinance existing SBA 504 1st mortgages so another lender doesn’t take loan and relationship

- Refinance your own SBA 7(a) loans into SBA 504 loans using our 1st mortgage

- Do out of market deals nationwide so another lender doesn’t take loan and relationship

- Eliminate legal lending limit issues to a single borrower since we book the loan

- Satisfy customer needs without affecting your balance sheet

SBA 504 Refinance Program

Refinance non-SBA guaranteed commercial real estate loans into a more affordable SBA 504 loan.

Learn more about the program:

- Loan-to-Value Limitations

- Key Guidelines

- Eligible Project Costs

- Expenses

- How to Evaluate Eligibility

- Steps to Qualify Existing Debt

Contact Us

Enter your contact information below, and one of our team members will be in touch.