A full array of national wholesales SBA 1st mortgage options

Solutions for your commercial real estate needs

- Momentus Direct Capital partners with the nation’s leading funding partners to provide banks with access to 100% direct funding or purchases of SBA-504 first mortgages.

- SBA 504 Originations / Refi Existing 504 & 7(a) / SBA 504 Debt Refi

- Refinance existing SBA 504 1st mortgages so another lender doesn’t take the loan & client relationship

Who we work with

Whether you are a non-bank lender, credit union, CDFI, CDC, loan broker, or real-estate broker, our products bring real value to your business by offering rates and terms to satisfy your customer’s needs and win deals

How it works

Direct funding

Our funding partner directly funds the loan and thus the selling lender does not have to use its own capital. This transactional approach with our funding partners allows the selling lender to maintain a broad client relationship.

Purchase

Selling lender books the first mortgage loan on its balance sheet, then sells it to the funding partner.

Terms & Highlights

| Funding Partner | Morgan Stanley | City First | New York Life Impact 504 Loan Fund |

| Loan Type | CRE Purchase or Refinance | CRE Purchase; Refinance; Improvements | CRE Purchase; Refinance; Improvements |

| 1st mortgage loan amount | No min Max $10 million | $500 thousand – $10 million | No min Max $3 million |

| Rate | Up to 25-year fixed | 10-year fixed | 25-year fixed |

| Location | Nationwide | California, Washington, D.C., Maryland, Virginia Must be located in an LMI community or majority minority community, or Minority-owned | Nationwide |

| Max Loan-to-Value | 60% | 60% | 60% – 65% |

| Debt Service Coverage Ratio | 1.2 DSCR | 1.20 OC / 1.25 Global DSCR | 1.0 – 1.1 DSCR |

| Credit Score | 680 FICO | 660 FICO | 650 FICO |

| Amortization | 25-year fully amortizing fixed rates | 25-year amort / 10-year fixed (10-year term & 30-year amortization available in certain industries) | 25-year fully amortizing fixed rates |

Download Fact Sheet for Full Terms US Treasury Constant Maturity Index

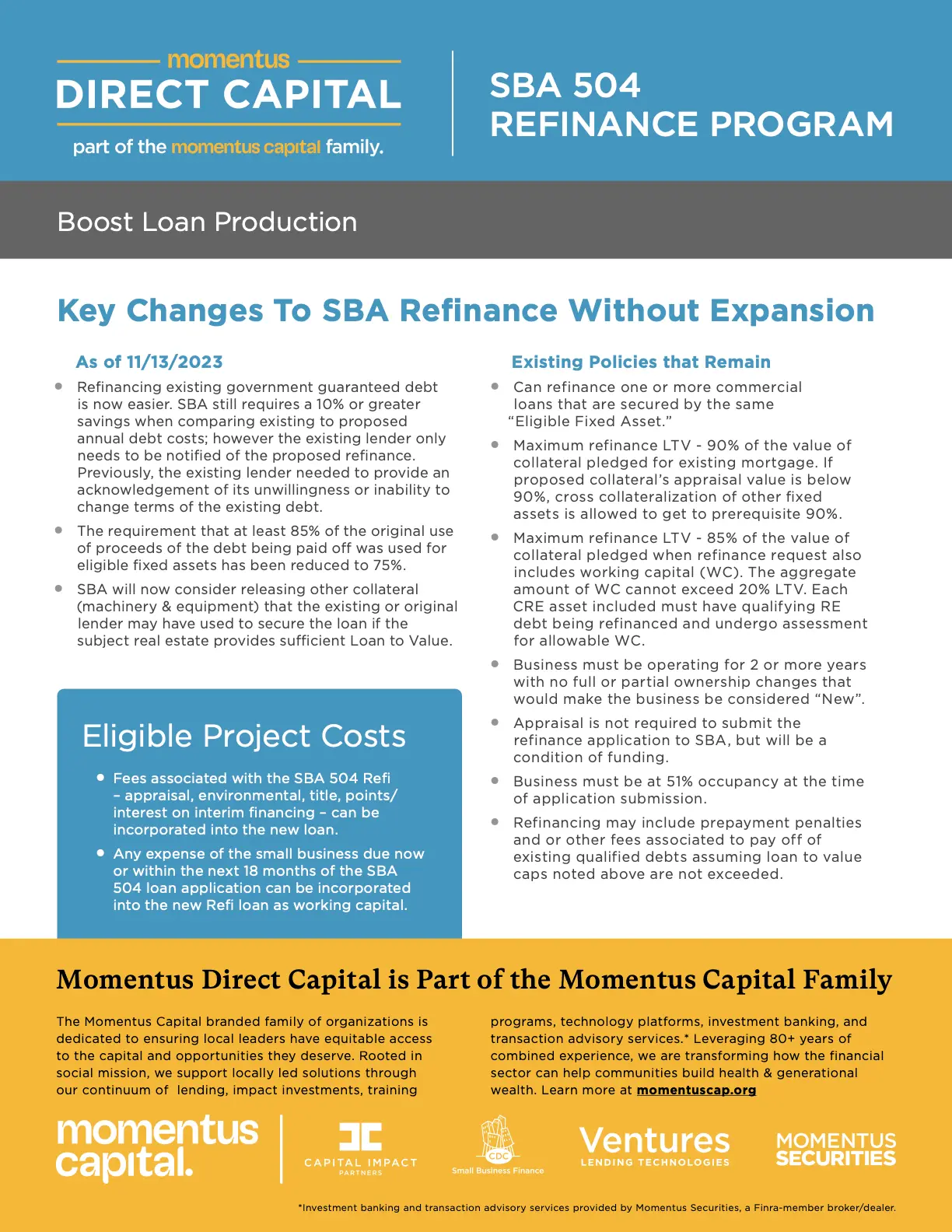

SBA 504 Refinance Program

Refinance Non-SBA guaranteed commercial real estate loans into a more affordable SBA 504 loan.

Learn more about the program:

- Key Guidelines

- Eligible Project Costs

- Expenses

- How to Evaluate Eligibility

- Steps to Qualify Existing Debt

- Loan-to-Value Limitations